Budgeting 101: Four Steps to Create a Monthly Budget

Budget…you either love this word or hate it. It’s okay, especially at the start of your journey but trust me, you will come to love it…well at least like it. With a plan and practice, you will be able to create a monthly budget in no time.

What is a Budget?

A plan. It’s that simple. A budget is a plan where you assign all of your money on paper before the month starts. That’s it. However, you won’t leave it there. You must also make an effort to stay within walls of the budget that you just built. When you create a monthly budget, also known as a cash flow plan, keep in mind that this is meant to give you freedom, not restrain you.

When you allocate your money to the things that are the most important to you, you are free to spend within those limits while having the assurance that all of your necessities are covered.

Why Do I Need a Budget?

Have you ever had cash in your wallet and the next thing you know it is gone, but you aren’t really sure where or how you spent it? Now imagine this happening to all of the money that comes into your account. That’s a really upsetting feeling, isn’t it. By not having a monthly budget, you are essentially throwing away your money.

Would you trust a building that is constructed without a blueprint? Would you trust an airplane that was just kind of put together? How about investing in a business that didn’t have sound business plan? So why would you run your personal finances in this manner?

The budget is the foundation of your financial journey. Think of it as the blueprint to your financial success. With a budget, you are taking control of every dollar that comes into your hands and telling it where to go and what to do. With a plan in your hand, you will be able to answer the question, “what did I do with my money?”.

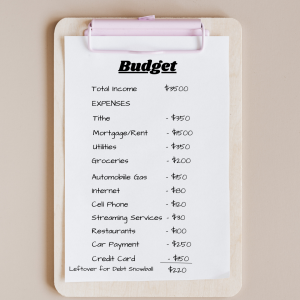

How to Create a Monthly Budget

Realize that a budget does not have to be a comprehensive spreadsheet with complicated formulas. Keep it simple! We will walk through the steps to create a basic monthly budget. The easier we make this process, the higher the probability that you will stick to it. So let’s look at four basic steps to help you create a monthly budget.

Step 1: List your Monthly Income

You can’t spend money you don’t have, so let’s get started by listing all of the income that you bring into the home for the month. If you are a salaried employee, this is pretty straight forward. If you are an hourly employee, entrepreneur or are on a commission plan, this can be a bit tricky.

The best way to ensure all of your expenses are covered, use the least amount you would bring in, and use that as your base income number. This will lead to pleasant surprises when you are able to work overtime or have a great sales month. You will also not be as stressed wondering if the month with run out before the money.

Don’t forget to include any additional income no matter the size. This includes dividends, royalties, child support, disability or retirement.

Step 2: List Your Monthly Expenses

Next, you will list all of the expenses that you incur monthly. Of course this includes the basic household expenses:

- Tithe

- Rent/Mortgage

- Electricity

- Natural Gas

- Internet

- Cell Phone

- Cable/Streaming Services

- Groceries/Restaurants

- Automobile Gas

- Childcare

- Car Payment

- Clothing

Don’t forget the extra annual expenses that can be set up as sinking funds. A sinking fund is an annual expense that you save for monthly so that the entire amount is available when the bill is due. Examples of this may include:

- Auto Registration

- Life Insurance

- Car Insurance

This may take some time the first few months because there are expenses that won’t come to mind immediately. It is okay to tweak the budget as needed as long as everything is listed.

Step 3: Don’t Forget Your Debts

If you don’t have any debt, you are ahead of the game! Congratulations. Unfortunately, this is not the story for most people. It’s important that if you owe it that you make a plan to pay it. We will address the paying off these debts later. For now, it is important that we keep current by including minimum payments for each debt in the budget. Be honest here. It is the only way you will win.

Step 4: Figure out what is left and allocate it

After you have taken care of all of your expenses and covered the minimum payments on all of your debts, there may be extra money left on the bottom line. No, this does not give you license to go on a shopping spree. We aren’t quite done yet. We will now allocate this money to your savings and sinking funds.

Emergency Fund

If you do not have your starter emergency fund, we will start here. The starter emergency fund of $1000 is recommended to serve as your pillow in case you fall. It’s not a full safety net, however, it can keep you from charging an emergency on a credit card while working through the process of paying off debt. If you have money left at the end of the month but you don’t have a fully funded started emergency fund, you will allocate the extra to this line item. Once you have $1000, you are set!

Debt Snowball

Remember, I told you we would get back to this. The debt snowball is where you list all of your debts from smallest to largest with the purpose of paying off each debt in order. Once you pay off the first, you will take both the minimum payment and the extra money allocated and start paying off the next debt on the list. You will continue this pattern until all of the debts are paid off.

As you are planning the budget, any extra money after your expenses have been covered and your emergency fund is fully funded, will be allocated to the debt snowball. The more extra money you find in budget, the faster you are able to pay off your debt.

Sinking Funds

Once upon a time, people used to actually save up for the things that they wanted. Imagine that! In the budget, we call those sinking funds. You are literally sinking money into an account so that it can build until you need it. This can be used for semi-annual/annual bills, special occasions like birthdays or Christmas and for those big ticket items like vacations or cars.

Determine the amount that you plan to deposit into the individual sinking fund monthly and make it a line item in the budget. Each month move this money from your operating account to a savings account. It is also important that you keep track of how much money is in each sinking fund whether it is on a spreadsheet or using an app like Mint or EveryDollar.

Keep going until every dollar of income coming into the budget has a purpose and a name. This is what we call a zero-based budget. By not leaving any extra money on the table, you have full control over how you plan to spend it. Feel free to change the allocations within the categories as you see fit during the month. You can be flexible as long as you are not spending more than you earn and you are using common sense. If you run out of money in the clothing budget, do not take money from your electric bill to buy a new outfit.

It is important to update your budget every month. While some expenses remain consistent, others can be variable such as gas, electric bills and even food. In order to really win with your money, it must be a part of your daily life. Trust me, the more you do it, the easier it becomes.

Now it is your turn to create a monthly budget. Pull out a sheet of paper, create a spreadsheet or open the app of your choice and get started today!